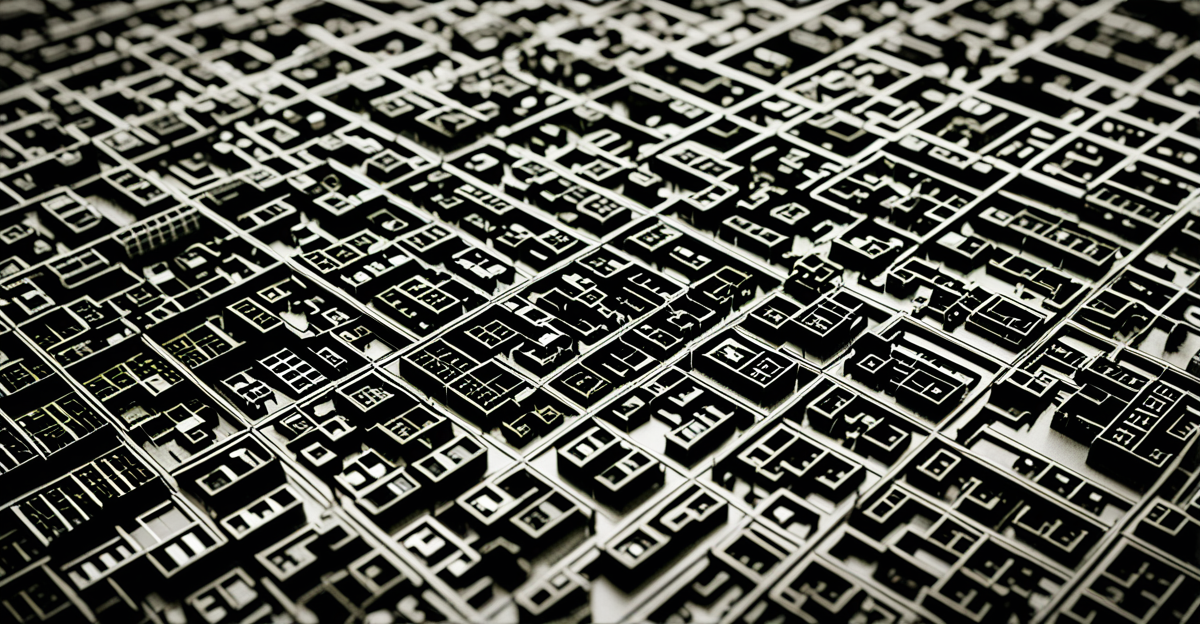

Overview of Current UK Real Estate Investment Trends

In 2023, the UK real estate market has experienced significant changes, shaped by global and local developments. Major investment shifts have been evident, as investors adjust strategies in response to these trends.

Analysis of Overall Market Changes

The first half of 2023 has seen a divergence in investment patterns. While some investors pulled back due to economic uncertainties, others capitalized on emerging opportunities. This was particularly evident in the commercial sector, where shifts towards flexible office spaces became prevalent.

Also read : How Does the UK’s Economic Climate Influence the Real Estate Market?

Key Statistics Showcasing Investment Patterns

Recent data reveals a 15% increase in interest in residential properties in regional cities, attributed to remote work trends. Conversely, the London market saw a dip in commercial property investments by 10%, reflecting the broader shift from traditional office spaces.

Insights from Recent Expert Reports

Experts from renowned financial institutions have highlighted that the rise in hybrid working models drives demand in suburban areas. Additionally, reports suggest a growing interest in sustainable buildings, reflecting a broader shift towards environmental consciousness in investment decisions.

Also read : What role does green finance play in the UK real estate sector?

Economic Factors Influencing Investment Shifts

In 2023, the economic impact on the UK real estate sector cannot be understated. Various market dynamics have shifted, significantly affecting the investment climate.

Current Economic Conditions Affecting Real Estate

Inflation remains a pivotal concern, directly influencing investment decisions. Higher inflation rates increase the cost of borrowing, subsequently affecting property affordability for both investors and consumers. This situation leads to a cautious approach in investments as stakeholders anticipate interest rate adjustments from the Bank of England. Consequently, increased interest rates make financing more expensive, influencing property demand and pricing strategies.

The Role of Government Fiscal Policies

Government fiscal policies, including changes in taxation and investment incentives, continually mold the investment terrain. For example, recent initiatives aimed at stimulating the economy have introduced incentives for sustainable development projects, encouraging investments in ‘green’ real estate. These policies not only project the government’s support for environmental goals but also enhance investor confidence in sectors aligned with these incentives. However, the investment climate is still susceptible to policy changes, indicating the need for investors to stay informed and adaptable.

Considerations for Investors

To navigate these economic influences, investors may consider focusing on properties that align with emerging fiscal incentives—notably sustainable building projects. Additionally, keeping abreast of monetary policy announcements could help in strategizing investment decisions effectively during fluctuating interest rates.

Regulatory Changes Impacting Real Estate Investment

In recent years, the UK real estate market has undergone notable regulatory changes aimed at navigating the complexities of modern housing needs. These government policies have redefined the investment landscape and continue to influence investor behavior.

Overview of Recent Regulatory Changes

The introduction of new housing laws has aimed at improving affordability and accessibility within the market. For instance, alterations in zoning laws have been pivotal in facilitating increased housing supply, thereby addressing growing urban demands. Moreover, regulations supporting sustainable construction have become more commonplace, encouraging developers to integrate eco-friendly methods in their projects.

Impact of Governmental Policies on Investment Behavior

Government policies, such as tax reforms and subsidies for first-time buyers, have significantly impacted investment behavior. These measures have not only encouraged individuals to enter the housing market but have also fostered confidence among investors targeting long-term assets. However, with policies frequently subject to change, the agility to adapt quickly remains crucial for investors striving to maximize returns.

Case Studies of Specific Regulatory Effects on Investor Confidence

An illustrative example is the relaxation of the stamp duty policy in 2022, which temporarily boosted residential property transactions. This regulatory adjustment heightened investor confidence, demonstrating how strategic policy shifts can invigorate market activities. Conversely, more stringent property development regulations in specific locales have necessitated recalibrations in investment strategies, underscoring the nuanced impact of regulatory changes on different market segments.

Regional Variations in Real Estate Investment

The UK real estate market is not a monolithic entity; there are distinct regional real estate trends that shape local investments. Understanding the market differences across the UK is essential for investors looking to optimize their portfolios.

Analysis of Investment Trends Across Different UK Regions

Investment patterns vary significantly between regions. In northern England, cities such as Manchester and Leeds are experiencing a boom in residential property investments, driven by lower property costs and increased rental demand. This contrasts with southern regions, where property values are higher, leading to higher barriers for entry.

Factors Driving Variation in Regional Performance

Several factors contribute to these regional variations. Economic diversity, such as the presence of technological hubs in some cities, can drive real estate growth. Additionally, infrastructure improvements, like the HS2 rail project, promise to enhance connectivity and regional development, further influencing local investments.

Highlighting Emerging Markets Within the UK

Emerging markets such as Bristol and Edinburgh have shown promise due to their thriving cultural and economic environments. These cities combine robust local job markets with attractive living conditions, making them hotspots for real estate investment. Investors are encouraged to explore these regions to capitalize on growth opportunities.

Understanding regional dynamics allows investors to tailor strategies effectively, ensuring they maximize returns according to local market conditions.

Future Forecasts for UK Real Estate Investments

The UK real estate market is poised for significant evolution over the next few years. Anticipated trends suggest that 2024 may see a continued shift towards sustainable building practices. Market forecasts indicate that eco-friendly developments will attract increased investor interest, driven by heightened consumer demand and evolving regulatory landscapes. This suggests a promising outlook for green real estate investments, aligning with broader environmental objectives.

Predictions for the UK Real Estate Market in the Next 1-3 Years

Analysts forecast that regional disparities will remain a defining feature of the UK real estate landscape. The northern regions, in particular, are expected to maintain their growth momentum due to attractive investment conditions and affordable property prices. Conversely, London might experience a slow recovery phase, attributed to its premium pricing and post-pandemic adjustments.

Use of Data to Anticipate Future Shifts in Investment

Leveraging data analytics, experts predict a surge in hybrid office spaces and properties catering to the remote work paradigm. Data points highlight a potential 12% increase in demand for properties that offer flexible workspace solutions. Such insights underscore the importance of data-driven decision-making, enabling investors to align with prospective market trends effectively.

Recommendations for Investors Based on Projected Trends

To navigate these evolving dynamics, it is advisable for investors to:

- Focus on regions with emerging technological hubs and infrastructure projects.

- Consider investments in sustainable property developments.

- Monitor policy changes impacting property taxation and environmental requirements.

By staying informed and adaptable, investors can align their strategies to optimize returns while contributing to sustainable urban development.

Actionable Insights for Investors

Navigating the complex landscape of UK real estate investment requires adaptable investment strategies. By honing in on emerging trends and investment shifts, investors can make informed choices. To mitigate risks and optimize returns, consider these approaches:

Strategies for Adapting to Current Market Shifts

In 2023, the investment climate is dynamic, with fluctuations in economic variables that impact decisions. Investors can benefit from a flexible strategy, focusing on sustainable developments and hybrid office spaces that align with the evolving market overview. By keeping an eye on market forecasts and data-driven predictions, investors can adjust their portfolios to minimize risks.

Identifying Opportunities Within the Changing Landscape

With regional real estate trends showing varied performance, pinpointing lucrative local investments is vital. Emerging markets in cities with growing technological hubs or improved infrastructure offer potential. Embracing areas with lower property costs and high rental demand, especially in the north, could yield promising returns.

Tips for Mitigating Risks Associated with Investing in UK Real Estate

Incorporating robust risk assessment methods is crucial. Monitor economic indicators like inflation and interest rates, which directly influence investment potential. Stay abreast of regulatory changes and government policies that can impact project viability. Diversifying across regions and property types can also shield against market volatility.